Silver's Silent Storm: Analyzing the 2025 Price Surge and Its Far-Reaching Impacts

AI Research Break Down Due to the Fast Rise in the Cost of Silver

I decided to pull some research on Silver after reading an Ask Perplexity post on X. One, I wanted to verify it, but two the meteoric rise of Silver the last week and really over the last month or so has been something to watch. Decided to get a little more into it and this China angle that could make things difficult in the tech industry and power grid especially. Interesting stuff.

~McShane

Executive Summary

In 2025, silver shattered long-standing price records, surging over 158% year-to-date to hover around $76 per ounce as of December 26. This isn’t mere speculation—it’s a confluence of depleted stockpiles, inelastic supply, skyrocketing industrial demand from AI data centers, electrification, and defense needs, compounded by China’s strategic export restrictions. While mainstream narratives focus on gold’s safe-haven allure, silver’s dual role as an industrial powerhouse and monetary asset positions it as a potential rate-limiter for global progress. Surprising revelations include classified military consumption possibly rivaling solar industry demand, and how trade tariffs inadvertently accelerated physical silver dislocations. This report reviews the viral X thread by @AskPerplexity, verifies its claims against current data, and explores broader implications for economies, geopolitics, militaries, and global supply chains. Bottom line: silver shortages could force painful trade-offs in tech and defense sectors, with prices potentially repricing abruptly if deficits persist.

Introduction: Dissecting the @AskPerplexity Thread

The X thread from @AskPerplexity, posted on December 26, 2025, captures silver’s predicament succinctly: prices breaking 14-year highs amid structural deficits, unrelenting demand, and China’s tightening grip. The post highlights a 158% year-to-date gain, with visuals showing the iShares Silver Trust (SLV) ETF at $68.97—aligning with spot prices around $70-75 after adjustments. Key claims include a cumulative 678 million ounce (Moz) deficit over four years (though updated charts suggest closer to 793 Moz through 2025 estimates), 70% of supply as mining byproducts, and irreplaceable uses in high-reliability electronics.

Visual aids in the thread, such as supply-demand bar charts and mine source breakdowns, underscore inelasticity: lead/zinc and copper operations drive most output, unresponsive to silver’s price alone. Demand charts reveal photovoltaics (solar) consuming over 30% of industrial silver by 2025, with AI and grid buildouts adding pressure. The meme—”SILENCE GOLD, SILVER IS TALKING”—aptly signals silver’s outperformance. Building on this, our analysis confirms the thread’s accuracy but uncovers deeper layers: military “black budget” usage may exceed public estimates, and political maneuvers like U.S. tariffs have triggered unprecedented stockpile shifts from London to New York.

Current Market Overview

Silver’s spot price stands at approximately $76.24 per troy ounce as of December 26, 2025, up 1.70% daily and 158.96% year-to-date. Futures for December 2025 trade around $73.755, with January 2026 at $74.390. This eclipses the 2011 peak of ~$49.80, marking the highest nominal levels in over four decades when adjusted for inflation.

Global mine production reached 819.7 Moz in 2024, with projections for a 2-3% increase to around 844 Moz in 2025, though down from 2016 peaks despite higher prices. The market faces a fifth consecutive deficit, estimated at 98 Moz for 2025, drawing down visible stockpiles to decade lows. Shanghai exchange stocks have plummeted, reflecting China’s domestic hoarding. Investment demand via ETFs surged, but industrial pull—expected to dip 2% due to economic headwinds—remains the core driver.

Top 20 Silver-Producing Nations

Based on the latest comprehensive data from the World Silver Survey 2025, here is a ranked list of the top 20 silver-producing countries for 2024 (in million ounces), which serves as a baseline for 2025 projections amid modest expected growth. These figures highlight Latin America’s dominance, with Mexico, Peru, Bolivia, and Chile collectively accounting for over 40% of global output.

RankCountryProduction (Moz)

Mexico 185.8

China 110.23

Peru 108.04

Bolivia 47.85

Chile 43.26

Poland 42.57

Russia 41.08

Australia 38.99

United States 36.2

Argentina 24.911

India 22.512

Kazakhstan 16.113

Sweden 11.6

Indonesia 11.5

Canada 9.5

This distribution underscores vulnerabilities: disruptions in top producers like Mexico (e.g., from labor issues) or China (policy-driven) could ripple globally.

Historical Pricing Analysis: The Last 20 Years

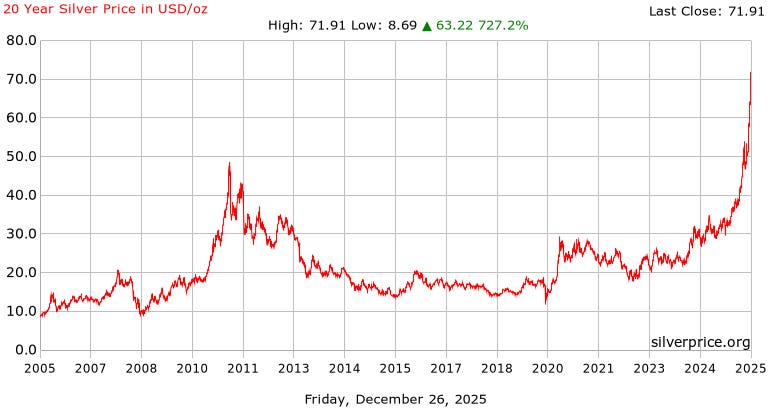

Over the past two decades, silver prices have exhibited remarkable volatility, reflecting its sensitivity to economic cycles, industrial shifts, and geopolitical events. Starting from an average of around $7.31 per ounce in 2005, prices climbed steadily amid post-9/11 economic recovery and rising commodity demand, reaching $11.55 in 2006 (+58%) and $13.38 in 2007 (+16%). The 2008 global financial crisis triggered a sharp drop to a low of about $9, but averages held at $15.03 as stimulus measures fueled a rebound. By 2009 ($14.67) and 2010 ($20.19, +38%), prices surged on inflation fears and quantitative easing.

The peak came in 2011 with an average of $35.12 (+74% year-over-year), driven by the U.S. debt ceiling crisis, European sovereign debt woes, and investor flight to safe havens. This mania gave way to a multi-year correction: 2012 averaged $31.15 (-11%), followed by steep declines in 2013 ($21.24, -32%) amid Fed tapering signals and economic stabilization. Prices bottomed in the mid-teens through 2015 ($15.69) and 2018 ($15.69), reflecting subdued industrial demand and stronger dollar pressures. A modest recovery in 2019 ($16.01) set the stage for 2020’s volatility ($19.46, +22%), where COVID-19 lockdowns crashed prices to $11.22 in March before safe-haven buying and supply disruptions propelled a rally to nearly $30 by August.

2021 saw another high ($25.13, +29%) on stimulus optimism, but 2022 ($21.77, -13%) and 2023 ($23.42, +8%) were marked by inflation fights and rate hikes. 2024 accelerated to $28.28 (+21%), foreshadowing 2025’s explosive average of $39.79 (+41%), with prices hitting a peak of $76.38 amid U.S. Federal Reserve rate cuts, escalating geopolitical tensions (e.g., U.S.-China trade frictions, Middle East conflicts), and booming industrial demand from EVs, solar, and AI. The compound annual growth rate (CAGR) over 20 years stands at approximately 12.8%, underscoring silver’s long-term upward trajectory despite periodic busts. Key trends include correlation with global risk aversion, industrial cycles, and monetary policy; surprises lie in how tech revolutions amplified 2025’s surge, outpacing even the 2011 boom.

Silver Price History

Supply Dynamics and China’s Strategic Play

Supply rigidity is silver’s Achilles’ heel: 72% comes as byproducts from copper (23%), lead/zinc (32%), and gold (12%) mining, limiting price-responsive expansion. New primary mines take 10-15 years to develop, with exploration budgets depleted after two decades of low prices.

China, the second-largest producer, dropped a bombshell in October 2025: starting January 1, 2026, silver exports require government licenses, limited to state-approved firms. This isn’t an outright ban but effectively gates supply, mirroring controls on rare earths and antimony. Amid U.S.-China trade tensions, this could slash global availability by 10-20%, exacerbating deficits. Surprise: while rare earth curbs were partially suspended in November 2025 amid a U.S. truce, silver restrictions persist, hinting at Beijing’s view of silver as a “strategic metal” for domestic AI and EV ambitions.

Stockpile depletion is acute: cumulative deficits hit 793 Moz from 2021-2025, equivalent to nearly a year’s mine output. Without buffers, any disruption—like labor strikes in Peru or energy shortages in Chile—could trigger volatility.

Demand Drivers: From AI Hubs to Battlefield Tech

Industrial demand hit records in 2024, comprising 60% of total usage, with 2025 projections showing slight softening but structural growth. Electrification is key: solar panels consume 35% of industrial silver via conductive paste, with EV wiring and grid upgrades adding more. AI data centers, projected to double power needs by 2030, rely on silver for efficient switches, relays, and cooling systems—potentially boosting demand by 5-10% annually. A 5,252% IT power surge translates to massive hardware needs.

Defense applications add a shadowy layer: silver’s superior conductivity features in missiles (10-15 oz per Tomahawk), satellites, fighter jets, and night-vision gear. Classified U.S. military usage may rival or exceed solar’s 200 Moz annual draw, per informed sources— a surprise underreported in public discourse. Substitutions like copper exist but increase size, heat, and failure risks, unviable at scale.

Economic Impacts: Ripples Through Industries and Markets

The surge has outpaced gold (up ~60%), driven by industrial fundamentals rather than pure inflation hedging. Positive: miners like MAG Silver saw 11.86% output gains, boosting revenues. Negative: higher costs squeeze solar manufacturers (thrifting silver use by 10-15%) and electronics firms, potentially inflating EV prices by 2-5%. Global economic uncertainty, including tariffs, led to a 4% demand drop in 2025, but deficits persist.

Surprise: tariff fears caused massive silver shipments from London to New York, distorting physical markets and fueling “mania” phases where prices could hit $100-300 in extreme scenarios. This could amplify inflation in tech-heavy economies, forcing central banks to balance growth with commodity pressures.

Political Implications: Geopolitics in the Minefields

Shortages amplify tensions: China’s controls weaponize its 15% production share, potentially retaliating against U.S. tech restrictions. Geopolitical events—wars in Ukraine/Middle East—spike safe-haven buying, while supply disruptions from unstable producers like Bolivia heighten risks.

The U.S. classifying silver as critical in October 2025 signals stockpiling efforts, echoing Cold War strategies. Surprise: trade truces (e.g., rare earth suspensions) exclude silver, suggesting Beijing’s long-game in dominating green tech supply chains. This could spark resource nationalism, with countries like Mexico tightening regulations.

Military Significance: The Unsung Battlefield Metal

Beyond economics, silver’s role in defense is understated yet critical. In hypersonic missiles, radar systems, and EMP-resistant electronics, it’s indispensable. Escalating global conflicts could consume 100-200 Moz annually—far exceeding public estimates—potentially outstripping industrial demand. Surprise: if full-scale wars erupt, silver shortages might delay deployments, forcing substitutions that compromise performance.

Global Perspectives: Winners, Losers, and Wild Cards

Latin America benefits as top producers, but environmental pushback and energy costs loom. Asia’s tech hubs face squeezes, while Europe grapples with green transition delays. Wild card: recycling ramps up, but covers only 20% of demand.

Conclusion: Outlook and Surprises

Silver’s 2025 story is one of overlooked constraints in a tech-driven world. With deficits set to continue into 2026, prices may outgain gold again, potentially reaching $100+ amid “abrupt repricings.” Key surprises: military demand’s scale, China’s subtle export weaponization, and how AI’s energy hunger indirectly devours silver. For investors and policymakers, this metal isn’t just shining—it’s signaling systemic vulnerabilities.